Imagine living a life where money isn’t a constant worry—where you can chase your dreams and enjoy experiences without stressing about bills. Sounds amazing, right? Well, achieving financial freedom isn’t just a dream; it’s a reachable goal! Myron Golden, a financial expert, teaches that mastering the basics is essential to unlocking this freedom. Understanding the key principles of financial success, embracing the right mindset, and recognizing how your environment influences your journey can pave the way to a more fulfilling financial future.

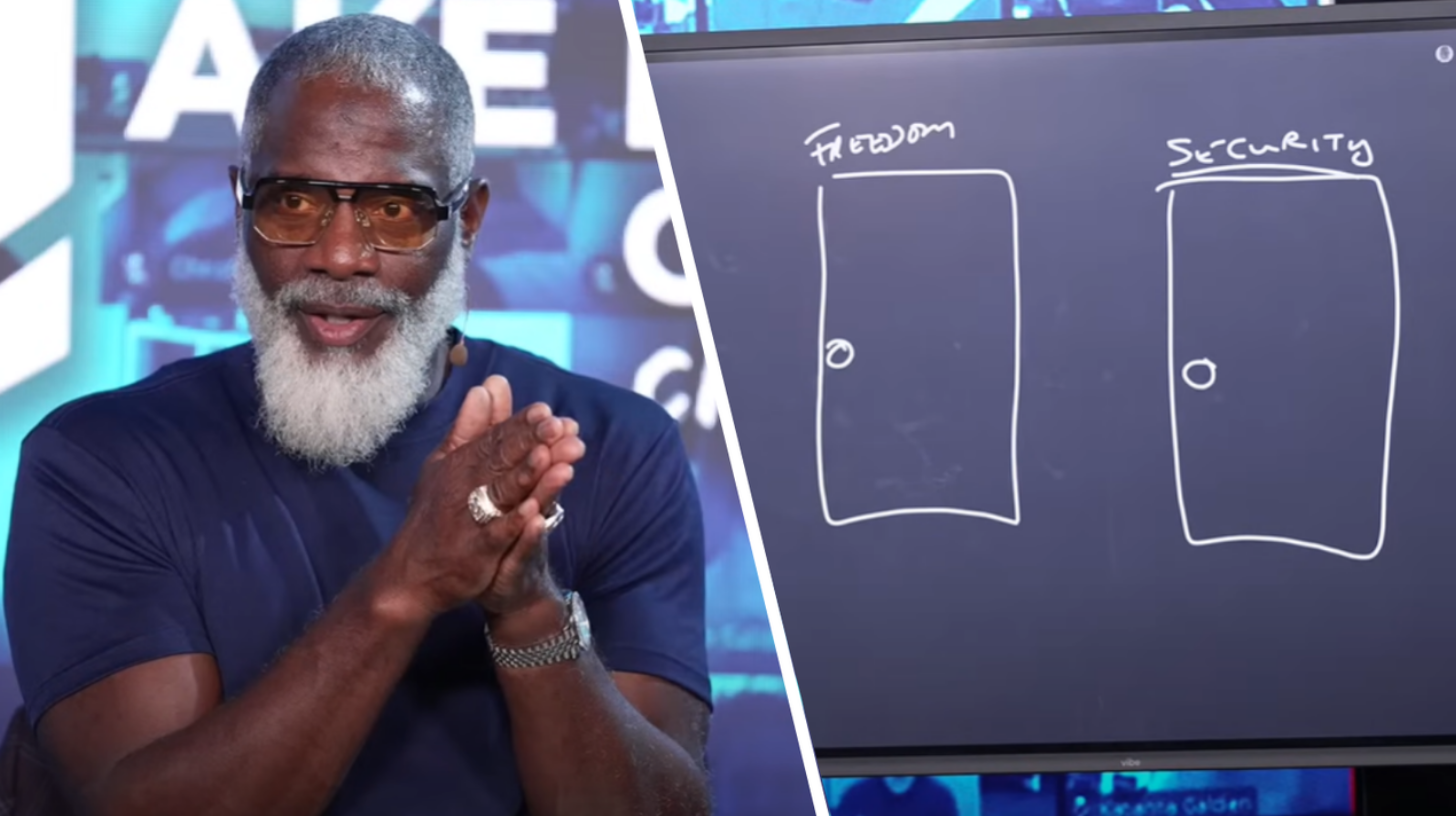

Understanding Financial Freedom vs. Financial Security

Before diving into the fundamentals, let’s clarify what financial freedom and financial security mean. Financial freedom is the ability to make choices without being limited by financial concerns. It’s about having enough income to cover your lifestyle without constantly worrying about money. On the other hand, financial security is more about stability—having a steady income and a safety net for emergencies.

Myron uses a metaphor of two doors to illustrate this: one leads to security, while the other opens to freedom and security. Choosing the path to freedom allows for greater opportunities and rewards, so it’s essential to aim for that! Many confuse these two concepts, believing they’ll achieve financial freedom if they secure a stable job. However, it’s not just about having a job; it’s about creating a financial ecosystem that allows growth, innovation, and flexibility.

The Power of a Positive Mindset

Did you know that your mindset can significantly influence your financial journey? That’s right! A positive, growth-oriented mindset is key to overcoming challenges and seizing opportunities. Myron emphasizes the importance of seeing life as a daring adventure. When you approach financial matters with optimism and openness, you’re more likely to take calculated risks and learn from failures.

Surrounding yourself with uplifting people and engaging with educational materials can boost your mindset, allowing you to tackle financial hurdles head-on. For instance, consider keeping a journal where you document your thoughts and feelings about money. Reflecting on your experiences can help you identify limiting beliefs and replace them with empowering thoughts. This practice can be beneficial when facing financial challenges; instead of viewing them as insurmountable obstacles, you can see them as opportunities to learn and grow.

Moreover, understanding that everyone has their financial journey can ease the pressure to compare yourself to others. Remember, it’s not a race; it’s about progress. By cultivating a positive mindset, you’re setting the stage for success, enabling you to navigate the winding path to financial freedom more effectively.

The Fundamentals of Financial Freedom

Let’s break down the basics that can lead you to financial freedom. These fundamentals include:

- Budgeting: Keeping track of your income and expenses is crucial. A budget helps you understand where your money goes and enables you to make informed decisions. Think of budgeting as a map for your finances—you might feel lost and overwhelmed without it.

- Saving: Setting aside money for emergencies and future goals builds a solid financial foundation. Aim to save at least 20% of your income whenever possible. This savings habit can create a financial cushion, helping you weather unexpected expenses like car repairs or medical bills.

- Investing: Putting your money to work through investments can help it grow over time. Explore options like stocks, bonds, and real estate to create wealth. Investing can seem intimidating, but starting small—like contributing to a retirement account—can make a significant difference in the long run.

- Discipline: Consistently making smart financial choices is essential. This means avoiding impulse purchases and sticking to your budget. A disciplined approach can help you prioritize long-term goals over short-term gratification, leading to greater financial stability.

- Education: Continuously learning about personal finance will empower you to make better decisions and adapt to changing circumstances. Read books, attend workshops, or listen to podcasts about money management to keep your knowledge fresh and relevant.

Focusing on these fundamentals can significantly improve your financial situation and help you work towards lasting freedom. Remember, these basics aren’t just one-time actions; they require ongoing commitment and adaptation as your financial situation evolves.

The Influence of Environment on Financial Success

Your environment plays a significant role in your financial journey. It can either support or hinder your progress. Myron shares his story of balancing a full-time job while building a business in his spare time. He emphasizes the importance of creating a conducive environment for financial growth, which can make all the difference. For instance, living in a state with lower taxes, like Florida, may provide a more favorable environment for achieving financial freedom compared to higher-tax states like California.

To enhance your environment, consider:

- Surrounding Yourself with Positive Influences: Engage with people who inspire and motivate you. Attend networking events and workshops to connect with like-minded individuals. A support system can make your financial journey less lonely and more rewarding.

- Limiting Negative Inputs: Be mindful of distractions and negative influences in your life. Reducing time spent on non-productive activities, like excessive TV watching, can free up time for personal development and entrepreneurial endeavors.

- Investing in Education: Immerse yourself in books, podcasts, and courses focusing on financial literacy. A well-informed mind can navigate challenges more effectively. Seek resources aligning with your financial goals and interests to deepen your understanding and motivate you.

Creating a supportive environment is a crucial step toward achieving financial freedom. It’s not just about physical space; it’s about fostering a mindset and community that encourages growth and learning.

The Importance of Perspective

Having the right perspective is crucial for overcoming obstacles to financial freedom. Myron emphasizes that a multifaceted view can help you see challenges as opportunities for growth. For example, instead of viewing setbacks as failures, consider them stepping stones to success. Engaging with differing opinions can strengthen your understanding and broaden your beliefs, which is essential in navigating the complexities of financial matters.

Additionally, it’s essential to recognize the context behind financial beliefs. Misunderstandings, like the idea that money is inherently evil, can skew our perspectives. Myron reminds us that wealth, when used responsibly, can be a powerful tool for good. Recognizing the nuances in these concepts can empower you to develop a healthier relationship with money.

To cultivate a balanced perspective, regularly reflect on your beliefs about money. Ask yourself questions like, “What do I truly believe about wealth?” and “How do these beliefs shape my actions?” This self-reflection can lead to greater awareness and a mindset shift supporting your financial goals.

Building Character and Self-Control

Character and self-control are fundamental to financial success. Myron argues that making rational financial decisions, rather than emotional ones, is crucial for achieving your goals. He emphasizes the need for focus and discipline, especially when life gets busy. It’s okay to sacrifice temporary balance for long-term success—prioritizing your financial goals is key!

To build self-control and character:

- Create Financial Goals: Set short-term and long-term goals to keep yourself motivated and focused. Break these goals into actionable steps, and don’t hesitate to adjust them as you learn and grow.

- Track Your Progress: Review your financial situation regularly to identify areas for improvement and celebrate milestones. This habit helps reinforce your commitment and allows you to see how far you’ve come.

- Practice Delayed Gratification: Learn to resist impulsive purchases and save for what truly matters to you. Consider the difference between needs and wants—this awareness can help you make more intentional spending decisions.

Developing strong character and self-control takes time, but these qualities are essential for navigating the ups and downs of your financial journey. Remember, every small step you take contributes to your overall growth and success.

Resourcefulness Over Resources

Myron highlights the importance of resourcefulness—using what you have creatively and effectively. He shares the story of Frederick Douglass, who, despite challenging circumstances, found ways to educate himself and achieve greatness. This idea resonates with many people; it’s not always about having a lot of resources but rather using your ingenuity and determination to make the most of your situation.

To cultivate resourcefulness:

- Think Outside the Box: Explore unconventional solutions to problems and seek creative ways to generate income. For example, consider starting a side hustle that aligns with your skills and passions—this can lead to new opportunities and additional income.

- Leverage Your Skills: Identify your strengths and find ways to use them to create value for others. Whether it’s tutoring, graphic design, or writing, your skills can be monetized in various ways.

- Learn Continuously: Stay curious and open to new ideas; they can lead to opportunities you never imagined. Attend workshops, online courses, or community classes to expand your skillset and network with others.

Being resourceful means embracing challenges and using them as stepping stones to success. Your creativity and determination will set you apart on your financial journey.

Energy and Discipline in Wealth Creation

Energy is a critical component of financial success. Myron explains that high income often results from high energy. Like a Boeing 747 requires powerful engines to fly, your financial journey needs energy and motivation to propel you forward. Discipline plays a vital role here; consistently doing what needs to be done, even when it’s tough, leads to lasting results.

To harness energy and discipline:

- Stay Motivated: Find inspiration in success stories and surround yourself with positivity. This could be through reading books about financial success or listening to motivational podcasts.

- Set Daily Routines: Create habits that support your financial goals, such as budgeting every week or reviewing your investments monthly. Routines provide structure and can help you stay on track.

- Celebrate Small Wins: Acknowledge your accomplishments, no matter how minor. Celebrating small victories can boost your motivation and encourage you to keep pushing forward.

By channeling your energy and maintaining discipline, you can create a powerful momentum to drive you toward financial freedom.

Take the First Step Towards Financial Freedom Now

Achieving financial freedom may seem daunting, but it’s entirely possible with the right mindset and a focus on mastering the basics. You can confidently navigate your financial journey by embracing Myron Golden’s insights. From understanding the importance of environment and perspective to cultivating self-control and resourcefulness, these principles will guide you toward a brighter financial future.

Are you ready to take the next step in your financial journey? Don’t miss the chance to register for the Make More Offers Challenge with Myron Golden. Visit myrongoldenlive.com to learn more about the next five-day challenge.

Leave a Reply